For Practical Trusted Advice

Contact us

Maurice Power Solicitors LLP

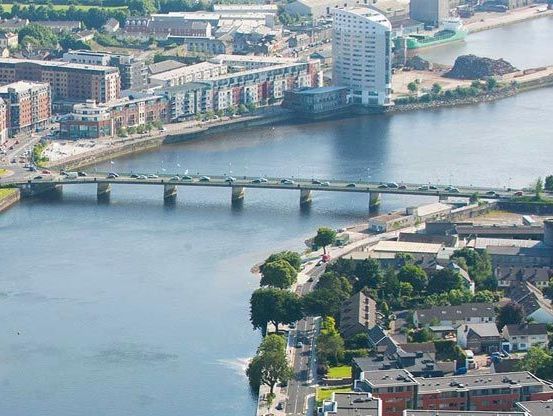

Maurice Power Solicitors LLP are a leading provincial Irish law firm who provide a complete range of legal services to both commercial and private clients.

Based in Limerick, Maurice Power Solicitors LLP was established in 1907 and since that time the firm has consolidated its presence in the Irish Legal sector, gaining a reputation for its skill in negotiating seminal rulings on behalf of a prestigious corporate and private client portfolio.

We take great pride in the strong reputation the firm has earned thanks to the efforts of our experienced and highly capable team of Limerick solicitors working across a diverse range of legal areas